The GST Council may move the sales and purchase invoice matching system to the back end. It will do so to keep tabs on missing transactions and check over-claim of input tax credits in the goods and services tax (GST).

At present, assessees claim input credits themselves by filing summary input- output returns, and the tax authorities do not have any clue whether the claims are correct or not. The process of invoice matching was supposed to be done by the assessees, though it was deferred till March. However, slowing GST revenues have now prompted the government to design an alternative mechanism, under which tax officials will do the matching themselves.

“Instead of asking taxpayers to match invoices, we may do it ourselves at the back end. We may follow a risk-based approach; when the gross level of transactions does not match, we may match invoices,” an official said, adding the proposal was under consideration.

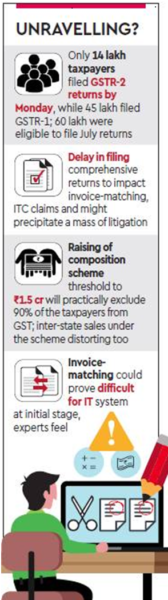

GSTR-1 (sales) and GSTR-2 (purchase) returns have to be matched with GSTR-3 to ensure that claims by taxpayers are correct. Both GSTR-2 and GSTR-3 returns have been postponed.

A committee, under GSTN Chairman Ajay Bhushan Pandey, is looking at ways of making the filing of the GSTR-2 and GSTR-3 forms business-friendly. The time period for filing the GSTR-2 and GSTR-3 forms for the months of July to March is also being worked out. The committee has recommended merging the GSTR-1, 2 and 3 forms as one option to simplify filing returns.

According to estimates, there is a 15-20 per cent GST revenue leakage at the moment.

GSTR-1 is used to file details of outward sales of a dealer. After submission, the details of purchases made by the dealer are automatically populated in the GSTR-2 form. The dealer is required to verify the details and submit the form. Finally, GSTR-3 calculates a taxpayer’s tax liability and the available input tax credit.

GST revenue collections touched their lowest in November at ~808 billion. According t0o the government’s estimates, if this trend continues, there could be a shortfall of ~250-300 billion in indirect tax collections this fiscal year. The government had attributed the slowing revenue to postponement of features of the GST such as matching of returns, electronic way bills and the reverse charge mechanism.

The revenue slowdown prompted the GST Council to call an urgent meeting on December 16 and advance the introduction of the electronicway bill for inter-state movements of goods to February 1 and for intra-state carriage from June 1.

“It is important that the concept of invoice matching continues as it is part of the basic design of the GST. If it is not done electronically, it will be needed at the time of assessment or audit, which will lead to more paperwork. The process can, however, be simplified,” said Pratik Jain, leader-indirect taxes, PwC India.

M S Mani, senior director-indirect taxes, Deloitte, said invoice matching provided taxpayers the ability to view transactions and take corrective steps on an ongoing basis. “While this may be cumbersome for small businesses, there are significant benefits for taxpayers and the government. However, the technology challenges will have to be overcome so that the matching happens seamlessly online in real time,” he said.

Bipin Sapra, partner— indirect taxes, EY, said, “In the absence of invoice level matching, the alternative is to match revenues and credits with GSTR1 but since the process will not be automated, it will be possible for a limited number of clients on the basis of risk assessment.”