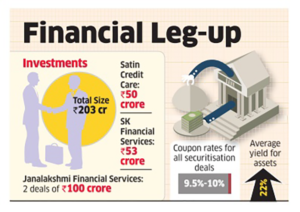

Micro Units Development & Refinance Agency (MUDRA) has recently closed its fourth deal with a total book of over Rs 203 crore, five months after it stepped into the securitisation market.

Micro Units Development & Refinance Agency (MUDRA) has recently closed its fourth deal with a total book of over Rs 203 crore, five months after it stepped into the securitisation market.

It has invested Rs 100 crore in two securitisation deals with Janalakshmi Financial Services and another Rs 50 crore in Satin Credit Care. It has also invested Rs 53 crore in SK Financial Services, a Jaipur-headquartered NBFC through a securitisation deal.

“We are directly investing in pass through certificates either as junior or senior investor,” Jiji Mammen, CEO, MUDRA, said.”All our investments are in healthy loan portfolios that will fetch us good yields.”

The coupon rates for all the securitisation deals are between 9.5 per cent and 10 per cent and the average yield for all assets was around 22 per cent, according to Mammen. Securitisation allows companies to provide part of their loan books and its receivables as guarantee to financial institutions. MUDRA was established as a subsidiary of Small Industries Development Bank of India (Sidbi) by PM Narendra Modi in April this year. The agency was set up with an initial corpus of Rs 5,000 crore to provide capital to all banks seeking refinancing of small business loans under Pradhan Mantri Mudra Yojna.

MUDRA’s latest attempt is to provide support to NBFCs and MFIs so that they in turn finance micro enterprises by participating in securitisation of their loan assets. It provides second loss default guarantee for credit enhancement and participates in investment of Pass through Certificate as senior or junior investor.

MUDRA has given loans of over Rs 1.3 lakh crore to 35 million borrowers. About 35 per cent of the total loans sanctioned last year were disbursed by MFIs. Among 45 per cent of the total loans disbursed by PSUs, 20 per cent was disbursed by SBI alone while 23 per cent was disbursed by private banks.

Of the planned disbursement of Rs 1.8 lakh crore this fiscal year, public sector banks would disburse Rs 77,700 crore, followed by Rs 21,000 crore by private and foreign banks, Rs 15,000 crore by regional rural banks, and Rs 64,240 crore by MFIs.

Source: http://economictimes.indiatimes.com/articleshow/54286037.cms