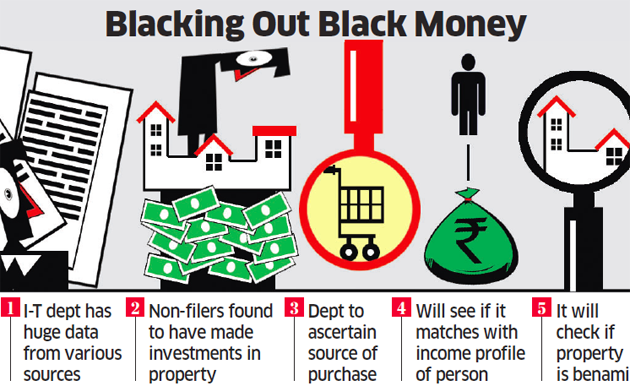

Income tax authorities plan to pursue those who have properties in their name but haven’t ever filed income tax returns on the suspicion that these may be benami holdings on behalf of people looking to conceal their wealth. The exercise is part of the government’s crackdown on black money.

The findings have emerged from the analysis of vast amounts of data that the government has collected. “We have a lot of data from various sources including on investments in property by people who have never filed returns,” said an income tax official. This information will be verified to ascertain the source of income used for the purchase of the properties and to see if these are being held by benami owners.

Spending and investment data are used to create profiles of individuals and matched with incomes declared in returns. Aside from this, more than 550,000 people have been identified for further probe as part of the second phase of Operation Clean Money for having deposited cash incommensurate with their declared income.

Besides this, some individuals reportedly carried out property transactions after demonetisation. The government had resolved to put in place a stringent framework to deal with black money soon after taking over in May 2014, in line with election promises. It has since taken a series of measures including the establishment of a special investigation team on black money and put in place a new law to deal with undisclosed overseas assets, apart from the benami legislation. Demonetisation of the Rs 500 and Rs 1,000 notes in November last year was also pitched as a battle against black money.

The department has now moved on to phase two of the operation, which also includes a crackdown on benami properties.

The Benami Properties (Prohibition) Act empowers the income tax authorities to confiscate and prosecute both the depositor and the person whose illegal money he or she has “adjusted” in their account. It attracts a heavy fine that could be as much 25% of the fair market value of the asset and rigorous imprisonment of up to seven years.

Real estate is a sink for money laundering. The annual information returns, that identify potential tax payers by examining their spending patterns, is useful to track evaders. Property registrars also file information returns. As the department gets a mine of information, it must deploy big data analytics to analyse these transactions. The need is also to bring real estate under the ambit of the goods and services tax to curb benami deals.

Source: The Economic Times