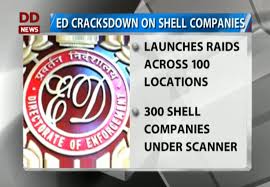

Weeks after the Prime Minister Narendra Modi’s office ordered a crackdown on shell companies used to launder money, the Enforcement Directorate on Saturday carried out nationwide searches across 100 locations targeting nearly 300 shell companies.

Sources said Saturday’s ED raids on shell firms across more than a dozen states was a direct fallout of the coordinated action against these firms. Among the cities where the Enforcement Directorate teams were conducting raids are Kolkata, Chennai, Delhi, Ahmedabad, Chandigarh, Patna and Bengaluru. In Chennai, officials said searches were being carried out at 13 locations linked to 8 companies.

The PMO had last month identified paper companies, which do not conduct any operations but are used to launder money and evade taxes by other firms, as a big challenge to PM Modi’s war against black money.

As part of this exercise, the government had also decided to create a database of shell companies and their directors. A task force chaired jointly by the Revenue Secretary and Corporate Affairs Secretary was mandated to coordinate action against these dubious companies.

That the 1,155 shell companies detected over the last three years had been used as conduits by over 22,000 beneficiaries to launder money, one government official said, indicated how important it was to target shell companies. These companies face charges of dubious transactions running into more than Rs. 13,300 crore.

It is not clear if today’s multiple ED raids on shell firms are linked to the government’s finding that over 550 people had laundered Rs. 3,900 crore through such companies after the November 8 ban on the high-denomination notes.

An official report had earlier pointed that only 6 lakh of the 15 lakh registered companies file annual return. While it was possible that many of them may be defunct, officials said it could be possible that some of these could be involved in dubious transactions.

The Special Investigation Team to fight Black Money set up on the Supreme Court’s directions had also pointed that proactive detection of shell companies was going to be a key to the success of the government’s campaign.