After years of subdued growth, the Indian microfinance (MFI) industry expanded more than 60% to Rs54,329 crore in 2015-16 compared to the previous year, according to a report prepared by Sa-Dhan, the self regulatory organisation of MFIs.

After years of subdued growth, the Indian microfinance (MFI) industry expanded more than 60% to Rs54,329 crore in 2015-16 compared to the previous year, according to a report prepared by Sa-Dhan, the self regulatory organisation of MFIs.

The MFI client base expanded by 2.8 million in the year, taking the total number of clients to 39.9 million, said the report. This growth was despite the fact that Bandhan, which was the largest MFI, moved out of the space to become a full fledged bank.

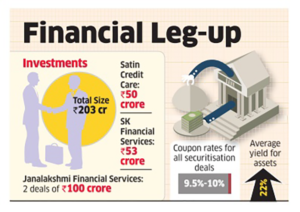

The top 10 MFIs classified as non-banking financial companies (NBFCs) accounted for about 80% of the total gross loan value, the report said. They include Janalakshmi Financial Services Ltd, Ujjivan Financial Services Ltd and SKS Microfinance Ltd.

“Attaining over 28 lakh clients is no mean feat. This goes on to show that the microfinance industry, having reached its inflection point, is growing steadfastly,” P. Sathish, executive director of Sa-Dhan, said.

The MFI sector experienced a crisis after Andhra Pradesh, the biggest market for small loans made to the unbanked poor and self-employed, in 2010 clamped down on micro lenders.

The state government tightened regulations governing MFIs after reports surfaced that coercive loan recovery practices by the lenders had driven some overextended borrowers to commit suicide. That led to a shrinking of the asset base of the microfinance industry and a surge in bad loans.

Of the total client base of 39.9 million, the southern region alone contributed to 39% of the total client base. Kerala and Karnataka now have the maximum number of MFI branches.

The growth in this sector is also due to Reserve Bank of India allowing many NBFC-MFIs to act as banking correspondents (BCS) connecting commercial banks with customers in small towns and rural areas.

“The MFIs are finding the BC model rather attractive on the credit side,” Sathish added.

The report also claims that 94% of the total loans taken from MFIs are for income generating activities, dominated by agriculture and animal husbandry.