Singapore has replaced Mauritius as the top source of foreign direct investment (FDI) into India during the first half of the current financial year.

Singapore has replaced Mauritius as the top source of foreign direct investment (FDI) into India during the first half of the current financial year.

During April-September 2015, India has attracted $6.69 billion (Rs 43,096 crore) FDI from Singapore while from Mauritius, it received $3.66 billion (Rs 23,490 crore), according to data from the Department of Industrial Policy and Promotion (DIPP).

Foreign investment from Singapore was $2.41 billion in the year-ago period.

According to experts, the Double Taxation Avoidance Agreement (DTAA) with Singapore incorporates Limit-of-Benefit (LoB) clause, which has provided comfort to foreign investors based there to invest in India.

“Investors are preferring Singapore to Mauritius as the LoB clause in India-Singapore treaty provides substance and certainty,” said Krishan Malhotra, head of tax and an expert on FDI with corporate law firm Shardul Amarchand and Mangaldas.

FDI from Singapore during the first six months of the current financial year is also more than what it had invested in India for the whole of 2013-14 ($5.98 billion). India had attracted $6.74 billion foreign investment during 2014-15.

![]() Overall, Singapore accounts for 15 per cent of the total FDI India received between April 2000 and September 2015. However, Mauritius makes up 34 per cent of FDI during the same period.

Overall, Singapore accounts for 15 per cent of the total FDI India received between April 2000 and September 2015. However, Mauritius makes up 34 per cent of FDI during the same period.

Sectors that attracted the highest foreign investment during April-September 2015 include computer software and hardware ($3.05 billion), trading ($2.30 billion), services and automobile ($1.46 billion each) and telecommunications ($659 million).

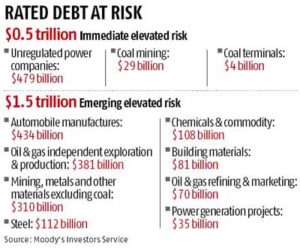

Foreign investment is crucial for India, which needs about $1 trillion by March 2017 to overhaul infrastructure such as ports, airports and highways, and to boost growth.