The corporate affairs ministry today asked states to complete identification of properties owned by deregistered companies at the earliest and ensure district administrations prevent transactions in those assets.

Amid intensifying efforts to fight the black money menace, the ministry has also urged the states to initiate disciplinary action against the officials concerned in case such transactions go through.

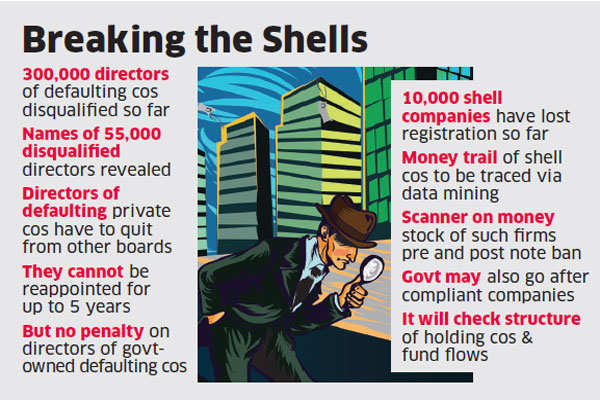

The names of around 2.25 lakh companies which have not been carrying out business activities for long have been struck off the official records and a number of directors associated with such firms have been disqualified.

Against this backdrop, Minister of State for Corporate Affairs P P Chaudhary today held a review meeting with representatives from various states on action taken with respect to properties belonging to around 2.09 lakh deregistered companies.

During the meeting, Chaudhary asked the states’ representatives to complete the process of identification and tracking of properties belonging to such companies at the earliest, according to an official release.

In this regard, the states have been requested to share information with the ministry in a time-bound manner.

On September 12, the ministry had sent a letter to states for identification and tracking of properties belonging to around 2.09 lakh companies that were deregistered. Now, the number of such firms is about 2.25 lakh.

Additional state-wise information pertaining to such companies was also shared with the state representatives.

According to the minister, since the country-wide land records have been computerised, it would not take much time for the states to provide the requisite information to the district authorities and the central government.

Since the names of the companies have been struck off, any transaction pertaining to properties owned by them, their directors or authorised signatories would be “void ab initio and a nullity till such companies are restored by an order of the National Company Law Tribunal (NCLT), the release said.

“In fact, by virtue of the company’s name having been struck off from the Register of Companies under the Companies Act, 2013, its identity as a legal person had been lost and hence, the legal ownership of properties belonging to such a company was non-existent,” it added.

Chaudhary advised the representatives to ensure that requisite directions are urgently issued to all the district authorities dealing with registration of properties to put in place appropriate mechanism to prevent transactions in properties belonging to the deregistered companies.

Officials allowing registration of transactions in such properties by ignoring the requisite directions may be subjected to disciplinary action, he told the representatives.

Emphasising that tackling of shell companies is an imperative element in the fight against black money, Chaudhary said such a drive would help unearth benami properties and discourage illegal practices, which would create a healthy economic environment for honest businessmen.