India today promised a conducive environment for Chinese investors and urged them to participate in ‘Make in India’ and other flagship programmes of the government to boost bilateral trade.

“We will facilitate your efforts to make your investments in India profitable. We must take advantage of the opportunities that abound in the growth of both our economies,” said President Pranab Mukherjee addressing a meeting of the India-China Business Forum here on the second day of his four-day visit to China.

The forum, attended by industrialists and businessmen of both sides, was told by the President that India would like to see greater market for Indian products in China in a bid to balance bilateral trade which is now in China’s favour.

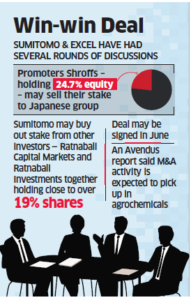

This, he said, would particularly be needed in sectors where the two countries have natural complementarities as in drugs and pharmaceuticals and IT and IT-related services and agro products.

“It is a matter of satisfaction that there is emerging focus on two-way investment flows,” he said.

The President noted that the bilateral trade between India and China has grown steadily since the turn of this century from USD 2.91 billion in 2000 to USD 71 billion last year.

Guangdon province boasts of a USD one trillion economy with high manufacturing and other industries along with being a powerful export house of China. It has sister province relationship with Gujarat and Maharashtra.

A pilot smart city cooperation project has been announced between Shenzhen and the Gujarat last year.

Referring to the links of 2nd century before the Christian era between Guangdong and Kanchipuram through a direct sea route, Mukherjee said this is an exciting time for India and China to reinforce the old linkages and join hands for new.

Noting that India has recorded a growth rate of 7.6 per cent each year for over a decade now, he said India believes that it cannot grow in isolation.

“In an increasingly interconnected world, India would like to benefit from technology advances and best practices of different countries.

“The comprehensive reforms introduced in key areas of our economy have enhanced the ease of doing business in India. Our foreign investment regime has been liberalised through simplified procedures. And removal of restrictions on foreign investments,” he said.

The President said these reforms have renewed the interest of global investors in India. In 2014, there was a 32 per cent growth in investments and in 2015, India emerged as one of the biggest global investment destinations, he said.

Mukherjee said India would like more of China’s overseas direct investment which has now crossed USD 100 billion mark.

He said the Indian government was setting up industrial corridors, national investment and manufacturing zones and dedicated freight corridors to stimulate investment in this sector.

Its ‘100 Smart Cities” initiative will transform India into a digitally empowered society and knowledge economy, he said.

“India welcomes your participation in these programmes. Chinese companies with inherent strengths in infrastructure and manufacturing can look towards India as an important destination in their ‘Going Global’ strategy.

“On their part, Indian companies can partner with Chinese enterprises in the new domain of ‘Internet of Things’ which underlines the ‘Made in China 2025’ strategy,” he said.

The President said he was happy to note that a good start has been made by Chinese businesses who are investing in infrastructure projects and industrial parks in India.

Bilateral cooperation in India’s railway sector is also progressing well, he said.

A good number of premier Indian IT firms and other manufacturers are present in China, he said and noted that Indian entrepreneurs were also considering the prospects of jointly exploring opportunities in third countries.

Summing up, the President said India believed there was great potential for economic and commercial cooperation among the two countries, which faced similar opportunities on coming together.

“To realise the full potential of our economic partnership, it is important to bridge the information gap between our business communities.

“We are committed to providing a conducive environment for more investments from China. We stand ready to facilitate many more collaborations between the industry and businesses of our two countries across different sectors. India invites investors from China to be partners in India’s growth story,” he said.

Source:

http://economictimes.indiatimes.com/articleshow/52428771.cms