Marking its debut in the Indian solar sector after its investment announcement of $20 billion, Japan’s SoftBank won its first solar power project in India. The Japanese firm won the 350 megawatt (Mw) project, under the Jawaharlal Nehru National Solar Mission (NSM), through its joint venture (JV) company SBG Cleantech.

Marking its debut in the Indian solar sector after its investment announcement of $20 billion, Japan’s SoftBank won its first solar power project in India. The Japanese firm won the 350 megawatt (Mw) project, under the Jawaharlal Nehru National Solar Mission (NSM), through its joint venture (JV) company SBG Cleantech.

SBG Cleantech bid the lowest tariff of Rs 4.63 per unit to win the entire tendered capacity of 350 Mw. This is the lowest bid this year for solar power. Last month, US firm SunEdison had won a 500-Mw solar power park in Andhra Pradesh at the same tariff.

Indiabulls’ Yarrow Infrastructure, Azure Power, Reliance CleanGen, Goldman Sachs-backed ReNew Power, US’ First Solar and China’s Trina Solar were also in the fray.

“Our goal is to create a market-leading renewable energy company, to fuel India’s growth with clean, reliable and affordable sources of energy. I am glad we could open our account with this win. This project will immensely contribute to the Prime Minister’s vision of meeting the country’s energy demands through clean sources and India’s commitment to providing a safe environment, following the recent Paris convention,” said Nikesh Arora, president and chief operating officer of SoftBank, in a statement.

In June this year, SoftBank had tied up with Foxconn and Bharti Enterprises to invest in the Indian solar energy sector, committing $20 billion. This is its second bid participation after the AP solar park and the first win for any power project through its JV, SBG Cleantech.

“SoftBank is establishing itself as a serious player. The company is likely to be a strong contender in the upcoming national bids as well,” said Jasmeet Khurana, associate director (consulting), Bridge to India.

SBG Cleantech has Bharti veterans Manoj Kohli as executive chairman and Raman Nanda as chief executive. The company is headquartered in New Delhi.

“Of the 100 gigawatt (Gw) target set by the PM, the SoftBank venture will look at solar power generation of 20 Gw. The investment will be made through the next 10 years. Acceleration will depend on the support of the central and local governments, and NTPC,” SoftBank founder & CEO Masayoshi Son had said in June during the launch of the joint venture.

According to market experts, the recent bids show there are only 10-12 developers who have the appetite to continuously try and take up large projects at current tariff levels, which has gone below Rs 5 a unit.

“The government and power distribution companies must be happy about the results and this might be good for continued policy support for new allocations across India. With such results, the states are likely to be much more willing to allocate land to solar parks and take the NSM route to attract solar investments,” said Khurana.

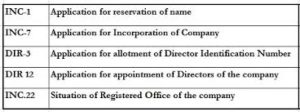

Sun Power

Company Tariff (Rs per unit)

SBG CLEANTECH LTD (SoftBank) – 4.63

Yarrow Infrastructure Limited (IndiaBulls) – 4.64

Azure Power India Private Limited – 4.76

Reliance CleanGen Limited – 4.88

ReNew Solar Power Private Limited – 5.17

MIRA ZAVAS PRIVATE LIMITED (China’s Trina Solar) – 5.18

Marikal Solar Parks Pvt Ltd (US’ First Solar) – 5.34

*Parent institutions in brackets