India improved its ranking by one spot in a global index of business optimism, with policy reforms and Goods and Services tax (GST) expected to become a reality soon, says a survey.

According to the latest Grant Thornton International Business Report, India was ranked second on the optimism index during the third quarter (July-September 2016).

Indonesia took the top spot, with the Philippines coming in third.

India was ranked third during the April-June period after being on top for two consecutive quarters.

“The improvement in the optimism ranking in the recent past clearly reflects that the reform agenda of the government and its efforts on improving the climate for doing business are having an impact,” Grant Thornton India LLP Partner – India Leadership Team Harish H V said.

High business optimism was also complimented by the rise of employment expectations. India regained its top position on this parameter, from second position in the April-June period, while profitability expectations also moved up.

“…all the programs and initiatives of the government as well as its focus on building relationships with all major economic powers has made India a bright spot in the global economy,” Harish said, adding the recent push for GST augurs well and should give a further boost to business optimism.

While India continues to be amongst the top five countries citing regulations and red tape as a constraint on growth, for the first time in the year, the country’s ranking on this parameter has dropped from second to fourth.

As per the survey, 59 per cent of the respondents have quoted this as an impediment in the growth prospects compared to 64 per cent in the previous quarter.

The report is prepared on the basis of a quarterly conducted global business survey of 2,500 businesses across 36 economies.

Meanwhile, in terms of revenue expectations, India slipped to third position from top in the previous quarter.

In spite of the downturn, India is much ahead of China where only 30 per cent respondents expect an increase in revenue, whereas in India, 85 per cent respondents have voted in favour of increasing revenue.

The survey further noted that 68 per cent of respondents have voted for an upsurge in selling prices. On this parameter too, China lags India with only 10 per cent of respondents expecting an upsurge in selling prices. The global average is 19 per cent.

Globally, business optimism stands at net 33 per cent, rising 1 percentage point from the previous quarter but falling 11 percentage points over the year.

“Political events such as Brexit and the US presidential election understandably rattle the global economy and test the resilience and elasticity of businesses worldwide. In general, businesses do not like uncertainty, and that is what is happening,” Grant Thornton Global CEO Ed Nusbaum said.

Source : http://economictimes.indiatimes.com/articleshow/55277143.cms

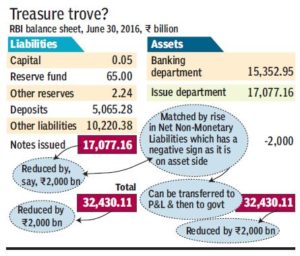

If those with black money do not convert all their R500/1,000 notes to new ones for fear of the taxman discovering their hoards, the government could reap a rich bonanza.

If those with black money do not convert all their R500/1,000 notes to new ones for fear of the taxman discovering their hoards, the government could reap a rich bonanza.