Considering India’s notable policy reforms in the renewable energy sector, Bloomberg New Energy Finance has ranked the country at fifth place on a list of 30 countries on ease of doing business in the renewable energy space. The ranking done by Bloomberg New Energy Finance’s annual Climatescope report indicates that clean energy’s centre of gravity is shifting from developed to developing countries. The report ranked China in the first place, followed by Chile, Brazil, South Africa and India.

Considering India’s notable policy reforms in the renewable energy sector, Bloomberg New Energy Finance has ranked the country at fifth place on a list of 30 countries on ease of doing business in the renewable energy space. The ranking done by Bloomberg New Energy Finance’s annual Climatescope report indicates that clean energy’s centre of gravity is shifting from developed to developing countries. The report ranked China in the first place, followed by Chile, Brazil, South Africa and India.

The report said: “The new policy ambitions from the (Narendra) Modi government signal clean energy opportunities in the country.” The strongest parameter in favour of India was value chain, while lower-than-expected investment continues to be the weak link.

As solar energy became more cost-competitive in emerging markets in 2014, there would be a surge of investment and capacity-building in the Asian countries, especially China and India, the report noted. Last year, India added 5 gigawatt (Gw) of clean energy generation capacity.

|

CLEAN BREAK IN RENEWABLE SPACE

|

- $343.2 billion Total clean energy investments (2009-14) in China

- $52.5 billion Total clean energy investments (2009-14) in India

- 262.5 Gw Installed power capacity

- 38,360 Mw Total renewable energy capacity

- 5,009 Mw Renewable capacity added in 2014

- 14.6% Renewable share in total installed capacity

- Top Indian states: Tamil Nadu, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan & Gujarat

|

“Major reforms in India brought by the Modi administration bring hope of quicker deployment for the country’s eager renewable energy developers,” said Climatescope.

Among the states, Tamil Nadu led the pack with the highest wind energy capacity, followed by Karnataka, Madhya Pradesh, Maharashtra, Rajasthan and Gujarat.

Madhya Pradesh scored the highest among Indian states on growth rate of clean energy investments. The state’s favourable land policy and easy clearances have resulted in attracting projects. Gujarat, which was once a haven of clean energy investments, slipped from the top slot due to policy uncertainty and litigation over tariff.

Maharashtra’s high feed-in tariff led to a surge in wind capacity.

The report noted: “Maharashtra has done relatively little to encourage private investment in solar; it has held no tenders for power contracts and offers no feed-in tariffs.”

Renewable energy in Rajasthan at 4 Gw represents a high share (32 per cent) of total power capacity of 13 Gw, compared to other states. “The overall renewable energy capacity grew 14 per cent in 2014 in the state, but it has done little policy-wise to encourage solar development through incentives and the state’s distribution utilities are among the financially shakiest in India,” said the report.

At 7.4 Gw, Tamil Nadu has more wind installed than any other state. Since 2012, however, annual new-build rates have fallen and in 2014, only 208 megawatt was commissioned. This is largely due to the poor financial health of state-owned distribution utility companies and occasional payment delays to power project owners.

The Indian government’s goal of providing round-the-clock power to 1.25 billion citizens has triggered huge interest from investors. The report noted that a strong energy minister overseeing coal, power, and new and renewable energy sectors could have a positive influence.

The Modi-led government has revised the targets for renewable energy to 175 Gw by 2022.

Source: http://www.business-standard.com/article/economy-policy/india-5th-on-doing-biz-in-clean-energy-115112300009_1.html

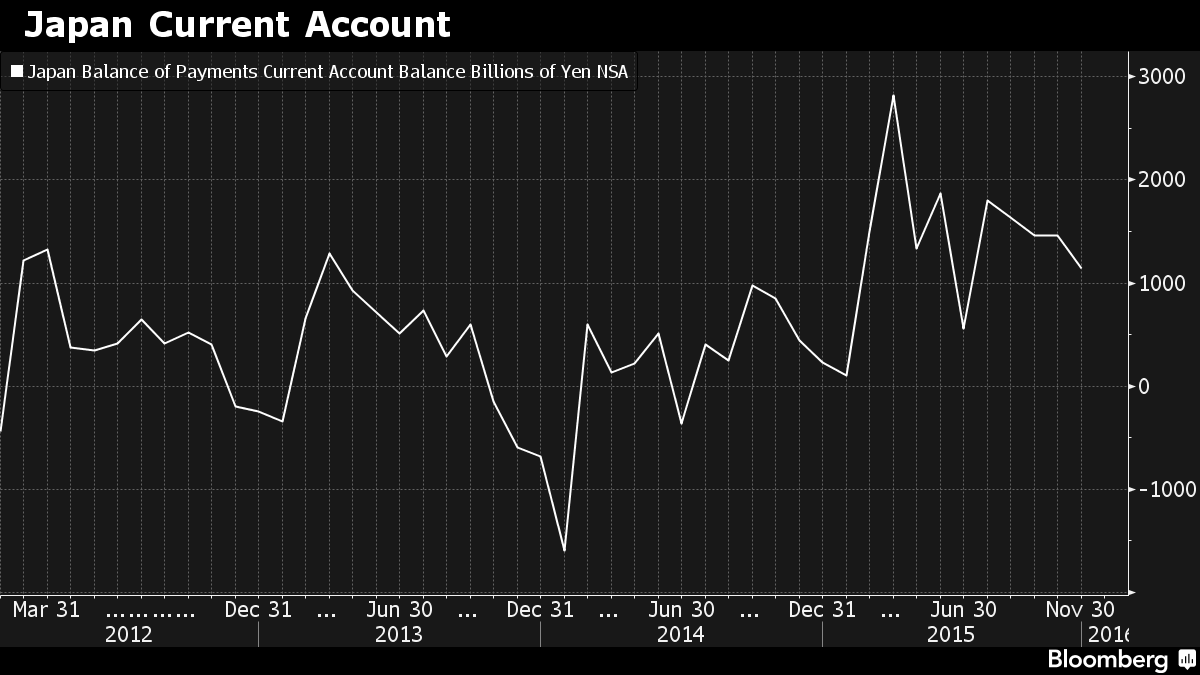

Japan posted a current account surplus for the 17th consecutive month in November, providing support for Prime Minister Shinzo Abe’s efforts to boost the world’s third-largest economy.