Foreign direct investment into India has grown by 35 per cent in the last 17 months even as across the world it has fallen by 16 per cent, a top Union government official said today.

Foreign direct investment into India has grown by 35 per cent in the last 17 months even as across the world it has fallen by 16 per cent, a top Union government official said today.

“FDI in India has grown by 35 per cent at a point of time when FDI across the world has fallen by 16 per cent,” Department of Industrial Policy and Promotion Secretary Amitabh Kant told reporters here.

He said ‘Make in India’ was launched in end-September last year and since then FDI has grown by 40 per cent as compared to the previous year, “but if you look at the last seventeen months of this government FDI has grown by 35 per cent as compared to the previous seventeen months.”

FDI has come into manufacturing, consumer goods, logistics and food processing sectors, he added.

Kant was today given additional charge of the post of CEO, NITI Aayog, consequent to the completion of tenure of Sindhushree Khullar.

Asked about the additional charge, he said “…I have not yet taken over.”

On startups, Kant said, “there is a huge energy, vitality and dynamism amongst startups in India and we need to carry this forward from digital startups to manufacturing startups, to startups in agriculture and social innovation areas, and from tier one to tier two and three cities.”

“The Prime Minister will be launching the Startup India movement on January 16 in New Delhi, we are inviting all the startups from Bengaluru to participate in this.”

“On that day we will link up all the IITs, IIMs, NITs and central universities for viewing of the startup India discussions from morning to evening,” he added.

He also said to provide a major impetus to the sector the Prime Minister will unveil the action plan for startups on that day.

On the economy, Kant said India is growing at 7.4 per cent and “it is an oasis of growth in the midst of a very balanced economic landscape across the world.”

“Challenge for India is to grow at 9-10 per cent over a long period of time over the next three decades or more,” he said.

“If India has to grow at 9-10 per cent India must become a very easy and simple place for people to do business….; It has to grow rapidly in manufacturing sector,” he added.

While speaking about the Make in India initiative of the government, Kant said Make in India week is being organised from February 13 to 18 in Mumbai, where about hundred countries are participating from across the world. Also, Asia business forum will be held during this event.

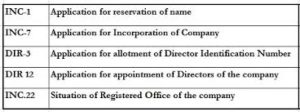

Stating that government is taking a series of measures to make India a very easy and a very simple place to do business, he said, “We have created an e-biz platform with Infosys where we have put twenty government services online with one single point of payment….”

“Our objective is that in the long run there should be only one identification number for the businessmen. The company identification, the labour identification and others should all get merged into one identification and there should be just one single form…..” he added.

Speaking about competition among states in ease of doing business, Kant said last year we had ranked the states on hundred points, this year we are doing it on 340 points.

“We expect Karnataka to do extremely well this year and take action on all 340 points and prove its position; Karnataka must come in top three,” he added.