With barely five days left for the roll-out of the goods and services tax (GST), the GST Network (GSTN), a company that provides information technology systems for the GST, reopened registration for assessees on Sunday.

With barely five days left for the roll-out of the goods and services tax (GST), the GST Network (GSTN), a company that provides information technology systems for the GST, reopened registration for assessees on Sunday.

The GST Council on Sunday made the dreaded anti-profiteering clause more palatable specifying a sunset clause of two years even as it relaxed the deadline for filing returns under the goods and services tax (GST) till September. The Council also approved five sets of rules but deferred a decision on the E-Way Bill rule. The GST — a uniform levy across the country — will be rolled out at midnight on June 30, ahead of which the council will meet again. Jammu and Kashmir and Kerala are yet to approve the State GST law.

The GST Council tweaked rates for luxury hotels giving relief to states relying on tourism. State-run lottery tickets will attract a levy of 12% while those run by private players will attract a higher GST of 28%. Rates for hybrid vehicles were not discussed at the meeting, the 17th Council meeting.

The anti-profiteering clause seeks to penalise businesses that do not pass on the benefit of a reduced incidence to customers. Any firm found to be profiteering, will pay a penalty equivalent to the amount of benefits gained under GST but not passed on to customers.

At a press conference, finance minister Arun Jaitley said he hoped the anti-profiteering rule would not be used.

Explaining how the anti-profiteering clause would work, revenue secretary Hasmukh Adhia said the GST implementation committee, a body comprising officers from states and central government, would pass on any complaints that it receives to the Director General of Safegaurd. “The DG of Safeguard will then take about three months to investigate the complaint and send its findings to the anti-profiteering authority,” Adhia explained.

“We may be able to refund the penalty to consumers in the case of commodities that can be tracked. However, for other commodities, the penalty amount will be deposited in the consumer welfare fund as provided under the GST Act,” Adhia added.

The simplified rules for filing returns require a taxpayer to file only a simple, self-certified return —by August 20 for July and September 20 for August. This would summarise inward and outward supplies rather than specify invoice-wise detailed returns as per GST rules. However, assesses must file the return with invoice details in September for both months. These will be matched with the simpler returns filed earlier, and any discrepancy would be liable to a fine, Adhia said.

The FM observed the IT platform—GSTN– was ready. “So far, 65.6 lakh of the 80.91 lakh existing assessees have migrated to the GSTN. This is a reasonably good number given many current taxpayers would be out of GST ambit due to the annual turnover ceiling of Rs 20 lakh,” Jaitley said. The FM added that there was a window of more than 30 days for new businesses to register.

The GST council approved five sets of rules including those relating to advance ruling, appeal and revision, assessment, anti-profiteering and fund settlement.

The anti-profiteering authority will be a five-member body; the chairman will be a secretary- level officer with four joint secretary level officers as members.

With the GST Council divided on the E-way rule—the manner in which consignments moving across states will be tracked–Jaitley said the transient rule would prevail pending a final decision.

Meanwhile, the Council raised the ceiling for hotel rooms attracting the highest tax rate of 28%– rooms costing more than Rs 7,500 per night will now be taxed at 28% compared to Rs 5,000 and above earlier. Similarly, services provided by restaurants in five-star hotels will now also charge 18%, down from 28% earlier. This has brought these restaurants at par with other air-conditioned restaurants.

The Council lowered the annual turnover limit for the composition scheme to Rs 50 lakh for the north-eastern and some other hilly states, at their request. Earlier, the composition limit for all states was increased from Rs 50 lakh to Rs 75 lakh. The composition scheme is applicable only to traders, manufacturers and restaurants.

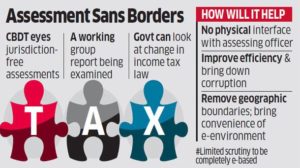

The one-nation, one-tax principle that underlines the goods and services tax (GST), set to be rolled out on July 1, could be adopted in a much more broader sense by the income tax department through a path-breaking initiative on jurisdiction-free assessment.

This would mean that a taxpayer in Mumbai could be assessed by an income tax officer located in Patna, a significant leap toward eradicating corruption by reducing the need for face-to-face contact between citizens and tax officials to the absolute minimum besides speeding up processing.

The move, which will require a change in the income tax law, would also end the relevance of various geographic divisions in the form of wards and circles with the whole country becoming one jurisdiction. This, it is hoped, will put an end to a system in which bribery is said to be used as a tool to ease processes through human intervention.

A high-level internal report of the Central Board of Direct Taxes (CBDT) recommended the move, which is under active consideration, a senior official told Economic Times.

“We are looking at it,” the CBDT official said.

The government may consider implementing the process in the next financial year.

The Catalyst

The key catalyst for such a significant reform is the massive shift toward e-filing of returns, which is already jurisdiction-free with returns going to the Central Processing Centre in Bengaluru.

In the last financial year, over 42.1 million tax returns had been filed online by February. The number of e-returns processed by then was 43 million, which included some backlog from previous years.

Multiple Benefits

In line with this move towards e-processing, the income tax department may even opt for e-scrutiny for all limited scrutiny cases where assesses can explain the transactions in question over email, the official said.

A complete jurisdiction-free environment would make geography redundant and the income tax department completely faceless for taxpayers. Any review or scrutiny of return could happen anywhere in India through an electronic interface, ensuring that the payee is not forced to interact with officials. “A taxpayer would not need to have any physical interface with his assessing officer,” said the official cited above.

CBDT had earlier constituted a seven-member committee to formulate a Standard Assessment Procedure for e-scrutiny to promote greater certainty, transparency and accountability. The board has in recent times taken a number of initiatives to reduce the face-to-face contact between tax officials and assessees and make the system non-adversarial.

These include directing field offices to raise only specific queries in income tax assessment cases picked up for scrutiny. It also directed the expeditious completion of those scrutiny cases where income concealed is up to Rs 5 lakh. “Jurisdiction-free assessment will help the tax department plan and allocate assessment work across the country,” said Jiger Saiya, partner, direct tax, BDO India.

Source: http://economictimes.indiatimes.com/articleshow/59026099.cms

Foreign investors have pumped $4.2 billion in the country’s capital market in May due to finalisation of GST rates for bulk of the items and prediction of a normal monsoon.

Interestingly, most of the funds have been invested in the debt markets by the foreign portfolio investors (FPIs).

“The differential spread between 10-year bond yields in the US and India is still around 4.5-5 per cent, this, coupled with stable outlook for the Indian currency bodes well for FPI flows into debt market,” Sharekhan Head Advisory Hemang Jani said.

According to latest depository data, FPIs invested a net Rs. 7,711 crore in equities last month, while they poured Rs. 19,155 crore in the debt markets during the period under review, translating into a net inflow of Rs. 26,866 crore ($4.2 billion).

This comes following a net inflow of close to Rs. 94,900 crore in the last three months (February-April) on several factors, including expectations that BJP’s victory in recently held assembly polls will accelerate the pace of reforms.

Prior to that, such investors had pulled out over Rs. 3,496 crore from debt markets in January.

“FPIs sold into Indian equities in the first few days of May. It was only in the second week that they started buying. The most prominent reason is expectation from the government that it would speed up development and economic reforms in their last two years in office before going for elections in 2019.

“The government finalising GST rates and expectation that it will be rolled out on time, in addition to forecast of normal monsoon also led to positive sentiments,” Himanshu Srivastava, Senior Analyst Manager Research at Morningstar India said.

Going forward, there are few challenges but not strong enough to disrupt the current trend. Markets and the rupee are surging higher, which offer a good profit booking opportunity for FPIs. They did that in April and they can again use this opportunity to book profits going forward.

“The flow is largely driven by expectation, and for the flows to sustain, the government has to meet those expectation. Monsoon will be another thing to watch out for as it tends to have big economic implications,” he added.

With the latest inflow, total investment in capital markets (equity and debt) has reached Rs. 1.21 lakh crore this year.

FDI inflows in the services sector rose by about 26% to $8.68 billion in 2016- 17 with the government taking steps to improve ease of doing business and attracting foreign investments.

FDI inflows in the services sector rose by about 26% to $8.68 billion in 2016- 17 with the government taking steps to improve ease of doing business and attracting foreign investments.

The services sector, which includes banking, insurance, outsourcing, research and development, courier and technology testing, had received foreign direct investment (FDI) worth $6.89 billion in 2015-16, according to data of the Department of Industrial Policy and Promotion (DIPP).

The government has taken several measures such as fixing timeliness for approvals and streamlining procedures to improve ease of doing business in the country and attract foreign investments.

With FDI growth in key sectors like services and telecom, the overall foreign investment inflows in the country too increased by 9% to $43.5 billion last fiscal.

Increasing FDI inflows in the services sector assumes significance as it contributes over 60% to India’s gross domestic product. The sector accounts for about 18% of the total FDI India received between April 2000 and March 2017, followed by key sectors such as computer software & hardware, construction development and telecommunications.

To further boost FDI inflows in the sector, the government is considering relaxation of policy in areas like single brand retail, multi-brand retail, print media and construction. The government is also focusing on enhancing services exports. It is organizing global services exhibition besides the commerce and industry ministry is looking at relax norms in areas like higher education to attract foreign players.

Foreign investments are considered crucial for India, which needs around $1 trillion for overhauling its infrastructure sector such as ports, airports and highways to boost growth. A strong inflow of foreign investments helps improve the country’s balance of payments situation and strengthen the rupee value against other global currencies, especially the US dollar.

India is becoming one of the favorite destinations for investments in manufacturing, clean tech, infrastructure and hi-tech for Finnish companies.

Nina Vaskunlahti, Ambassador of Finland to India, in an interview with BusinessLine said, “There is increasing interest in economic cooperation, and Finnish companies are looking for new opportunities in India.”

Investment protection

According to Vaskunlahti, although India’s legislative framework can be a little complicated and the judicial system overworked and under-resourced leading to delays in solving disputes for foreign investors, overall the atmosphere is “welcoming and pretty open”.

However, according to the Ambassador, Finland is worried over India’s move to terminate investment protection agreement with 82 countries. “We are not quite sure what is the purpose of this,” Vaskunlahti said. While the treaty between India and Finland is still in force, according to Vaskunlahti, India and the European Union seem to be stuck over negotiating a new investment protection treaty after a year back India had sent request for renegotiation for the Bilateral Investment Treaty (BIT) to over 80 countries with whom it had earlier signed Bilateral Investment Promotion and Protection Agreements (BIPA).

“As a member of EU, we cannot negotiate on our own, because it’s the EU Commission that has a negotiating mandate,” Vaskunlahti said. “What we have now on the table is called a comprehensive negotiating mandate which covers both free trade agreement and the investment protection agreement. For the moment, nothing much is happening, but efforts and work are being done in background to push it forward.”

The new model of the BIT was cleared by the Union Cabinet in December 2015 and was seen to give more stability to foreign investors and prevent disputes with multinational companies by excluding matters such as government procurement, taxation, subsidies, compulsory licences and national security.

Arbitration mechanism

At the same time, the new model BIT brings in a provision obliging foreign investors to first exhaust the option of local judicial system at least for five years before going to international arbitration mechanism in case of disputes.

Some of the cases when foreign investors challenged India in international arbitrage, invoking clauses of earlier BIPAs include Devas Multimedia, Vodafone, Deutsche Telekom, Sistema and Cairn.

There is an excitement in the country about GST. People want to understand the process of GST. Through this article, we present some points about the process of filing returns.

Every trader will have to file returns once a month and pay tax. The input credits of taxes that have been paid on purchases will be automatic and will be available to every trader. The whole process of filing returns is online. If accounts are kept in the Excel sheet provided by GSTN, then the same account will automatically be converted into returns with the help of an offline tool every month.

If a trader sells all his merchandise only to retail customers, then the returns of such a trader will be very simple – the summary of rate-wise turnover will be shown. If a trader avails of the composition scheme and has a turnover of less than Rs.50 lakh, such a trader will not have to file returns every month, but every three months, showing the total turnover.

Traders selling business-to-business merchandise must give specific details for each sale invoice in their returns. When a trader’s sales details are entered into the form of returns on the GST website by the 10th of the month, the complete details of purchases made by his buyers will be seen in his GSTR-2 (GST Online Account). That means it will auto-populate.

With the purchasing buyer clicking okay, after looking at these details, the merchant’s GSTR-3 return will appear in the computer itself. The GSTN system will auto prepare and show the merchant’s tax liability and the complete details of the input tax credit, along with net tax liability. The trader would be required to deposit the difference between tax liability and input tax credit. Taxes must be deposited online or in the bank.

After this, the trader will have to submit the final return made by computer by clicking on GSTR-3 and submitting it by the 20th of the month. There is an arrangement in business-to-business transactions which we call the input tax credit reversal, which is to return the input tax credit taken. A lot of people have expressed concern about this, but if you understand the whole process, then you would fully support it.

If the trader from whom you buy goods has shown that transaction in his return by the 10th of the month, you will get input tax credit. Suppose the person selling the goods does not put that invoice in his returns, even then you will get an opportunity to show it in your GSTR-2 return by the 15th of the month, and by doing so, you will get full input tax credit.

After that, you have to contact the businessman (the supplier) and explain that he must show that transaction in his return so that there is no reversal of the input tax credit received in the next month. You will get 30 days for this and if even then the merchant who sells the merchandise does not accept this transaction and does not show it in his return, then the input tax credit tax that you got would be reversed in your returns next month.

It is the duty of every businessman to deal with such traders who have deposited the tax with the government after collecting the tax from you.On the basis of the default of each merchant, they will be given a compliance rating, which will be visible to all other traders so that you do not do business with frequent defaulters.

Source: http://blogs.economictimes.indiatimes.com/et-commentary/gst-filing-returns-will-no-longer-be-taxing/