President Donald Trump vowed to end business as usual in Washington. Global companies are now learning just what that means.

President Donald Trump vowed to end business as usual in Washington. Global companies are now learning just what that means.

President Donald Trump vowed to end business as usual in Washington. Global companies are now learning just what that means.

President Donald Trump vowed to end business as usual in Washington. Global companies are now learning just what that means.

The decision, they said, to slap the stringent provisions of the Benami Transactions Act was taken after analysing serious cases where the illegalities were blatant and suspect cash was deposited in either benami accounts or Jan Dhan or dormant accounts.

The taxman had initiated a nationwide operation to identify suspect bank accounts where huge cash deposits have been made post November 8 when the government demonetised the Rs 500 and Rs 1000 currency notes.

Officials said the Act empowers the taxman to confiscate and prosecute both the depositor and the person whose illegal money he or she has “adjusted” in their account.

“Such an arrangement where a person deposits old currency of Rs 500 and Rs 1000 in the bank account of another person with an understanding that the account holder shall return his money in new currency, the transaction shall be regarded as benami transaction under the said Act.

“The person who deposits old currency in the bank account shall be treated as beneficial owner and the person in whose bank account the old currency has been deposited shall be categorised under this law as a benamidar,” a senior official had explained earlier.

India and the UK are expected to sign business deals exceeding GBP 1 billion (Rs 83,00 crore) during the three-day visit of British Prime Minister Theresa May, who is here on her first bilateral visit outside Europe since assuming office in July.

India and the UK are expected to sign business deals exceeding GBP 1 billion (Rs 83,00 crore) during the three-day visit of British Prime Minister Theresa May, who is here on her first bilateral visit outside Europe since assuming office in July.

Describing her talks with Prime Minister Narendra Modi as good and productive, May said as leaders, they both were working to improve the livelihoods of their citizens creating jobs, developing skills, investing in infrastructure and supporting technologies of the future.Talking about Modi’s vision of smart cities, May said they have agreed on a new partnership that will bring together government, investors and experts to work together on urban development, unlocking opportunities worth GBP 2 billion for British businesses over the next five years.

This will focus on the dynamic state of Madhya Pradesh with plans for more smart cities than anywhere else and the historic city of Varanasi.

Four rupee-denominated bonds worth a total of 600 million pounds ($748 million) are expected to be listed in London in the next three months, Theresa May said.

The latest four bonds will provide financing to expand India’s highway and rail networks and meet its plans to boost energy efficiency and renewable energy, the government said.

They will be issued by Indian government-backed corporates Indian Railway Finance Corporation, Indian Renewable Energy Development Agency, Energy Efficiency Services Limited, and National Highways Authority of India by the end of January 2017. May said since July, more than 900 million pounds rupee-denominated bonds have been issued in London, equivalent of more than 70 percent of the global offshore market.

“This government will continue to work closely with both India and our financial services sector to ensure our growing rupee bond market continues to help finance India’s ambitious infrastructure investment plans,” May said in a statement. These rupee-denominated or masala bonds as they are called, unveiled in 2015, are an opportunity for Indian firms to raise money, while giving international investors access to higher yields in a zero-yield world.

They are also a way to borrow overseas, they are also an attempt to make the tightly-controlled rupee more widely available in global markets, similar to the way in which China has moved to sell more yuan debt to overseas investors. Alongside this, the UK has agreed to invest GBP 120 million in a joint fund that will leverage private sector investment from the City of London to finance Indian infrastructure.

India improved its ranking by one spot in a global index of business optimism, with policy reforms and Goods and Services tax (GST) expected to become a reality soon, says a survey.

According to the latest Grant Thornton International Business Report, India was ranked second on the optimism index during the third quarter (July-September 2016).

Indonesia took the top spot, with the Philippines coming in third.

India was ranked third during the April-June period after being on top for two consecutive quarters.

“The improvement in the optimism ranking in the recent past clearly reflects that the reform agenda of the government and its efforts on improving the climate for doing business are having an impact,” Grant Thornton India LLP Partner – India Leadership Team Harish H V said.

High business optimism was also complimented by the rise of employment expectations. India regained its top position on this parameter, from second position in the April-June period, while profitability expectations also moved up.

“…all the programs and initiatives of the government as well as its focus on building relationships with all major economic powers has made India a bright spot in the global economy,” Harish said, adding the recent push for GST augurs well and should give a further boost to business optimism.

While India continues to be amongst the top five countries citing regulations and red tape as a constraint on growth, for the first time in the year, the country’s ranking on this parameter has dropped from second to fourth.

As per the survey, 59 per cent of the respondents have quoted this as an impediment in the growth prospects compared to 64 per cent in the previous quarter.

The report is prepared on the basis of a quarterly conducted global business survey of 2,500 businesses across 36 economies.

Meanwhile, in terms of revenue expectations, India slipped to third position from top in the previous quarter.

In spite of the downturn, India is much ahead of China where only 30 per cent respondents expect an increase in revenue, whereas in India, 85 per cent respondents have voted in favour of increasing revenue.

The survey further noted that 68 per cent of respondents have voted for an upsurge in selling prices. On this parameter too, China lags India with only 10 per cent of respondents expecting an upsurge in selling prices. The global average is 19 per cent.

Globally, business optimism stands at net 33 per cent, rising 1 percentage point from the previous quarter but falling 11 percentage points over the year.

“Political events such as Brexit and the US presidential election understandably rattle the global economy and test the resilience and elasticity of businesses worldwide. In general, businesses do not like uncertainty, and that is what is happening,” Grant Thornton Global CEO Ed Nusbaum said.

Source : http://economictimes.indiatimes.com/articleshow/55277143.cms

India improved its ranking by one spot in a global index of business optimism, with policy reforms and Goods and Services tax (GST) expected to become a reality soon, says a survey.

According to the latest Grant Thornton International Business Report, India was ranked second on the optimism index during the third quarter (July-September 2016).Indonesia took the top spot, with the Philippines coming in third.

India was ranked third during the April-June period after being on top for two consecutive quarters.

High business optimism was also complimented by the rise of employment expectations. India regained its top position on this parameter, from second position in the April-June period, while profitability expectations also moved up.

“…all the programs and initiatives of the government as well as its focus on building relationships with all major economic powers has made India a bright spot in the global economy,” Harish said, adding the recent push for GST augurs well and should give a further boost to business optimism.

While India continues to be amongst the top five countries citing regulations and red tape as a constraint on growth, for the first time in the year, the country’s ranking on this parameter has dropped from second to fourth.

As per the survey, 59 per cent of the respondents have quoted this as an impediment in the growth prospects compared to 64 per cent in the previous quarter.

The report is prepared on the basis of a quarterly conducted global business survey of 2,500 businesses across 36 economies.

Meanwhile, in terms of revenue expectations, India slipped to third position from top in the previous quarter.

In spite of the downturn, India is much ahead of China where only 30 per cent respondents expect an increase in revenue, whereas in India, 85 per cent respondents have voted in favour of increasing revenue.

The survey further noted that 68 per cent of respondents have voted for an upsurge in selling prices. On this parameter too, China lags India with only 10 per cent of respondents expecting an upsurge in selling prices. The global average is 19 per cent.

Globally, business optimism stands at net 33 per cent, rising 1 percentage point from the previous quarter but falling 11 percentage points over the year.

“Political events such as Brexit and the US presidential election understandably rattle the global economy and test the resilience and elasticity of businesses worldwide. In general, businesses do not like uncertainty, and that is what is happening,” Grant Thornton Global CEO Ed Nusbaum said

Source: http://economictimes.indiatimes.com/articleshow/55277143.cms

India continues to harbour the third largest start-up base, marginally behind the U.K., according to a Nasscom-Zinnov start-up report.

India continues to harbour the third largest start-up base, marginally behind the U.K., according to a Nasscom-Zinnov start-up report.

The report, titled “Indian Start-up Ecosystem Maturing – 2016,” says that the ecosystem is poised to grow by an impressive 2.2X to reach more than 10,500 start-ups by the year 2020 despite the popular belief that the Indian start-up ecosystem is slowing down.

There is an increased interest from student entrepreneurs this year, according to the report. A remarkable growth of 25 per cent has been witnessed in 2016 with over 350 ventures founded by young students. The median age of start-up founders has reduced marginally from 32 years in 2015 to 31 years in 2016.

“Technology start-ups are creating a new identity for India and its technological prowess,” said R. Chandrashekhar, President of the IT industry body Nasscom, in a statement. “They are defining the way the world operates making life better and easier for people and businesses alike.”

Some of the notable findings of the report include; continued growth in the number of start-ups in 2016, with Bengaluru, the National Capital Region, and Mumbai continuing to lead as major start-up hubs for the nation.

With this impetus, India will become home to over 10,500 start-ups by 2020, employing over 210,000 people reveals the report.

“Today, India is brimming with new ideas which need the right guidance and funding to be scalable for the market,” said C.P. Gurnani, Chairman, Nasscom, in a statement.

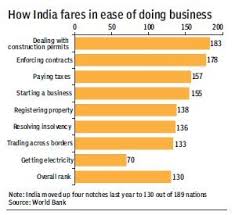

India continues to rank low at 130th position in terms of ease of doing business, with the country seeing little or no improvement in dealing with construction permits, getting credit and other parameters.

India continues to rank low at 130th position in terms of ease of doing business, with the country seeing little or no improvement in dealing with construction permits, getting credit and other parameters.

In the World Bank’s latest ‘Doing Business’ report, India’s place remained unchanged from last year’s original ranking of 130 among the 190 economies that were assessed on various parameters. However, the last year’s ranking has been now revised to 131 from which the country has improved its place by one spot.

The government has been making efforts to further improve the ease of doing business and aims to bring the country in the top 50.

Expressing disappointment over no change in India’s ranking in the World Bank’s index on ease of doing business, Indian government regretted that the report did not take into consideration 12 key reforms undertaken by the government.

When it comes to ‘distance to frontier’ — a measurement of the gap between an economy’s performance and the best practice score of 100 — India’s score has improved to 55.27 this year from 53.93 last year.

India is the only country for which the report has a box dedicated to its ongoing economic reforms.

The list of countries in the Doing Business 2017 is topped by New Zealand while Singapore is ranked second. It is followed by Denmark, Hong Kong, South Korea, Norway, the UK, the US, Sweden and former Yugoslav Republic of Macedonia.

Neighbouring Pakistan is ranked 144th in the list.

On the basis of reforms undertaken, the top 10 improvers are Brunei Darussalam, Kazakhstan, Kenya, Belarus, Indonesia, Serbia, Georgia, Pakistan, United Arab Emirates and Bahrain.

A record 137 economies around the world have adopted key reforms that make it easier to start and operate small and medium-sized businesses, the report said.

Developing countries carried out more than 75 per cent of the 283 reforms in the past year, with Sub-Saharan Africa accounting for over one-quarter of all reforms, it added.

“What we have seen is a remarkable effort on the part of the government to implement business reforms. It looks like we are going to have to wait for another year or so. But the direction of change is fundamentally a very significant one,” Global Indicators Group Director Augusto Lopez-Claros told PTI in an interview.

The rankings are based on ten parameters — starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency.

India has improved its ranking with respect to various areas. In terms of getting electricity, the country’s position has jumped to 26th spot from 51st place last year.

When it comes to trading across borders, the ranking has moved up one place to 143, and in enforcing contracts the rise is of six spots to 172nd position.

However, with respect to starting a business, the ranking has slipped four places to 155th spot and in the case of dealing with construction permits by one rank to 185th.

As per the report, India’s ranking in terms of protecting minority investors dropped to 13th place from 10th position last year.

With regard to getting credit, the ranking has fallen by two places to 44.

Explaining as to why India’s reform efforts is not being reflected in the ease of doing business report, Lopez-Claros said it very often takes some time for the reforms implemented by governments about the regulatory environment to be felt on the ground by the business community.

Rita Ramalho, Manager of the Doing Business project said that there were in fact improvements this year.

“There are four areas of improvement this year in India getting electricity, trading across border, enforcing contracts and paying taxes,” Ramalho told PTI.

India’s ranking is based on the study of the system in the two cities of Mumbai and New Delhi.

“The reason why there is no real movement in the ranking is more to do with the fact that other countries are also moving. In absolute terms India, does improve significantly.

There aren’t many countries that improved more than India in terms of absolute number,” Ramalho said.

The ‘Doing Business’ project provides objective measures of business regulations for local firms in economies and selected cities at the sub-national level.

The World Bank is emphasising that countries pay attention to what it calls “distance to frontier” which is an absolute metric, Lopez-Claros said.

“There has been actually substantial increase in the last 12 months in India by couple of percentage points, which is quite large,” he noted.