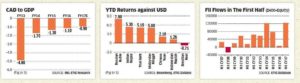

Foreign investors pumped over Rs 19,700 crore into the country’s stock markets in November, the highest in eight months, mainly due to government’s plan to recapitalise PSU banks and surge in India’s ranking in the World Bank’s ease of doing business.

In addition, such investors put in Rs 530 crore in the debt markets during the period under review.

According to depositories data, foreign portfolio investors (FPIs) invested a net amount of Rs 19,728 crore in equities last month.

This is the highest net investment by FPIs since March, when they had poured in Rs 30,906 crore in the equity market.It has been a tremendous journey for the Indian equity markets in 2017. After taking a break from buying into Indian equities in August and September, FPIs bought equities in abundance in November.

The strong inflow could be largely attributed to the government’s decision to recapitalise public-sector banks, which is expected to enhance lending and propel economic growth, said Morningstar India’s senior analyst manager (research) Himanshu Srivastava.

“This is particularly seen as a positive step after the questions have been raised from various quarters on the government’s ability to effectively implement economic reforms. Further, the slow pace of economic growth was also believed to be due to rising non performing assets (NPAs) problem in public sector banks, hence this decision provided a much-needed impetus to FPIs to again look back at Indian equity space,” he added.

Finance Minister Arun Jaitley had announced the PSU bank recapitalisation plan of Rs 2.11 trillion, out of which Rs 1.35 trillion will come from recapitalisation bonds, and the rest from markets and budgetary support.

India gained 30 places in the World Bank’s ease of doing business index for 2018 to 100th among 190 nations.

“These (bank’s recapitalisation plan and world bank’s ranking) and positive developments in the recent times provided a much-needed breather to FPIs who were concerned about the short-term impact of demonetisation and goods and services tax (GST) on the domestic economy and sluggish pace of economic recovery,” he added.