CBDT today issued a notification making it clear that information about those who declare their black money under the compliance window, ending September 30, will be kept secret.

The notification states that “no public servant shall produce before any person or authority any such document or record or any information or computerised data or part thereof as comes into his possession during the discharge of official duties in respect of valid declaration under the Income Declaration Scheme, 2016.”

The notification also quotes provisions of section 138 of the Income Tax Act which states that taxpayer related information is confidential and cannot be shared.

The fresh notification was issued by the Central Board of Direct Taxes (CBDT), a senior official said, as the department was getting a number of queries with regard to the confidentiality under the Income Declaration Scheme (IDS) or the one-time domestic black money compliance window.

Trade associations and industry bodies had also taken up the issue during their meeting with Finance Minister Arun Jaitley recently.

“The notification now gives legal sanctity to the word of the government that all information related to IDS will be kept confidential. It is aimed to end apprehensions in the minds of potential declarants that their information will find its way in the hands of other probe agencies or will reach the public domain,” the official said.

The IDS is open for four months, between June 1 and September 30 and the CBDT and the IT department have introduced a number of measures to make it a success.

CBDT has so far issued three sets of clarifications on Frequently Asked Questions (FAQs) to clear doubts and answer queries about the IDS.

The department has also published a country-wide list of registered asset valuers for those who wish to declare their untaxed funds and properties under this window.

The CBDT has also directed the taxman to step up publicity by advertising about the IDS at posh markets, clubs and showrooms. Besides, it has promised full privacy would be ensured for those making disclosures for better collections.

Under the scheme, the declarants will have to pay a total of 45 per cent in tax and penalty by November this year. Individuals and entities making disclosures will have immunity from prosecution.

IDS was announced with an aim to flush out black money from the domestic economy. It will apply to undisclosed income whether in the form of investment in assets or otherwise, pertaining to financial year 2015-16 or earlier.

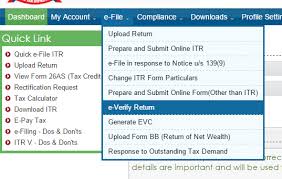

Declarations under IDS can either be made online on the official e-filing website of the tax department or before various regional Principal Commissioners of I-T department.

Source : http://economictimes.indiatimes.com/articleshow/53155906.cms

The department has begun publishing the names of tax defaulters in leading national dailies since last year and has named 67 such defaulters from across the country till now with their vital details like addresses, contacts, PAN card number and shareholders in case of companies.

The earlier exercise was restricted to people with huge defaults to the tune of about Rs 20-30 crore but the new measure will bring to the fore those names who have defaulted a tax of Rs 1 crore or more. “It has been decided to ‘name and shame’ all category of taxpayers including personal and corporate taxpayers who have a default of Rs 1 crore and above by March, 31 which is the end of 2016-17 financial year.

Source: http://indianexpress.com/article/business/economy/it-dept-to-name-and-shame-crorepati-defaulters-this-fiscal-2817347/#sthash.jCduzRT8.dpuf