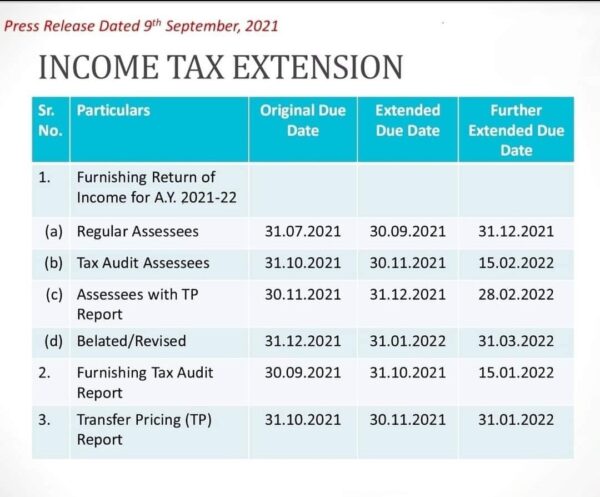

The government on Thursday extended the deadline to file income tax return (ITR) for FY 2020-21 by 3 months to December 31, 2021 from September 30, 2021. The extension of the deadline is for those individuals whose accounts are not required to be audited and who usually file their income tax return using ITR-1 or ITR-4 forms, as applicable.

In a statement, the Finance Ministry said that the decision has been on consideration of difficulties reported by the taxpayers and other stakeholders in filing of Income Tax Returns and various reports of audit for the Assessment Year 2021-22 under the Income Tax Act, 1961.

The income tax return (ITR) filing deadline for FY 2020-21 for individuals has already been extended, from the normal deadline of July 31, 2021. However, the new income tax e-filing portal has been marred by glitches and other problems from inception. Finance minister Nirmala Sitharaman has given Infosys, the company which set up the new income tax portal, time till September 15, 2021 to fix all the problems.

Last year too, the government has extended the due date of filing ITR for individuals four times – first from July 31 to November 30, 2020, then to December 31, 2020, and finally to January 10, 2021.

“On consideration of difficulties reported by the taxpayers in filing of Income Tax Returns(ITRs) & Audit reports for AY 2021-22 under the ITAct, 1961, CBDT further extends the due dates for filing of ITRs & Audit reports for AY 21-22. Circular No.17/2021 dated 09.09.2021 issued,” I-T Department tweeted on Thursday.

The due date of furnishing of report of audit under any provision of the Act for the previous year 2020-21, has been extended to January 15, 2022.

The due date of furnishing report from an accountant by persons entering into international transaction or specified domestic transaction under section 92E of the Act for the previous year 2020-21, is now January 31, 2022.

Again, the IT Department has decided to extend the due date of furnishing of Return of Income for the AY 2021-22, to February 15, 2022, among several other extensions.

The due date of furnishing of Return of Income for the Assessment Year 2021-22, which was December 31, 2021 has also been extended to February 28, 2022.

The due date of furnishing of belated or revised return of Income for the AY 2021-22 has been further extended to March 31, 2022.

Missing the ITR filing deadline would have had penal consequences. A late filing fee of Rs 5,000 would be levied if the ITR is filed by an individual after the expiry of the deadline.

Do keep in mind that government has also extended the deadline of filing belated ITR by one month from new deadline of December 31, 2021, to January 31, 2022. If the ITR is not filed by January 31, 2022, then the individual will not be able to file ITR for FY 2020-21, unless a notice is issued by the income tax department.

A late filing fee of Rs 5,000 along with penal interest at the rate of 1 per cent per month will be levied on the non-payment of tax dues in this case.