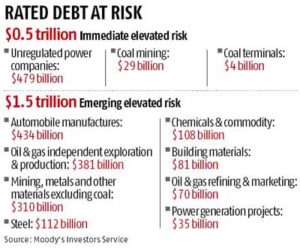

Many sectors, other than power and coal, face environmental risks that could translate into credit risk, according to Moody’s Investor Service. These include automobiles, oil & gas, mining, steel, and commodity chemicals. Moody’s has identified 11 sectors with around $2 trillion in rated debt as having credit exposure to environmental risks in the next five years.

At the same time, 57 sectors, representing $59 trillion of rated debt, are considered low risk, with environmental risks unlikely to materially impact credit quality. While some like telecommunication operate with fundamentally low exposure to environmental risks, others such as banks and insurance companies, have business diversity to mitigate their current exposures.

Unregulated power generators, which do not receive the benefits of cost recovery from their customers, coal mining and coal terminals, are the most exposed. Moody’s has developed a heat map that qualitatively scores the relative exposure of 86 sectors globally to environmental risks, in terms of both the materiality and timing of any likely credit effects. The amount of rated debt covered by this sector review is $67.9 trillion.

Environmental risks have been classified into two broad categories — the effects of environmental hazards, and the consequences of regulation designed to prevent or reduce those hazards.

Another set of 18 sectors, accounting for $7 trillion in rated debt, face environmental risks that could be material, but over five or more years. In this “emerging, moderate risk” category are developing economy sovereign and regional governments, integrated oil & gas companies and regulated power generation utilities. These have a clear exposure to environmental risks that could affect their credit quality. However, it is less certain that the identified risks will develop in a way to impact credit ratings for most issuers in these sectors.

Another set of 18 sectors, accounting for $7 trillion in rated debt, face environmental risks that could be material, but over five or more years. In this “emerging, moderate risk” category are developing economy sovereign and regional governments, integrated oil & gas companies and regulated power generation utilities. These have a clear exposure to environmental risks that could affect their credit quality. However, it is less certain that the identified risks will develop in a way to impact credit ratings for most issuers in these sectors.

“The longer runway to respond to risks could provide time to implement policy changes, adjust business models or financial profiles, or develop technological or lower-cost solutions, mitigating the impact of such risks,” said the report.

Sovereigns with developing economy as well as regional and local governments face increasing infrastructure challenges to manage environmental risks from water shortages, pollution or natural disasters. Unlike the overall scores, the sub-category scores were assessed based on the sector’s general level of exposure to that particular environmental risk, rather than any potential to affect ratings.