The CBDT today made it clear that Aadhaar will be a “must” for filing of Income Tax Returns or for obtaining a new PAN from July 1.

The CBDT today made it clear that Aadhaar will be a “must” for filing of Income Tax Returns or for obtaining a new PAN from July 1.

The policy—making body of the Income Tax Department issued a statement stating that the Supreme Court yesterday had only given a “partial relief” to those who do not have an Aadhaar or an Aadhaar enrolment ID, and the taxman, hence, will not “cancel” their Permanent Account Number (PAN).

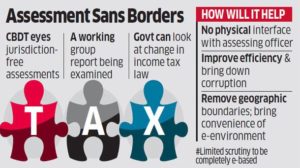

The Central Board of Direct Taxes (CBDT) issued a three— point “effect of the judgement” of the apex court statement saying:

From July 1, 2017 onwards every person eligible to obtain Aadhaar must quote their Aadhaar number or their Aadhaar enrolment ID number for filing of income tax returns as well as for applications for PAN.

“Everyone who has been allotted permanent account number as on the 1st day of July, 2017, and who has aadhaar number or is eligible to obtain Aadhaar number, shall intimate his Aadhaar number to income tax authorities for the purpose of linking PAN with Aadhaar,” it said.

It explained what will happen in a case of “non-compliance” or where a person does not possess Aadhaar.

“Only a partial relief by the Court (SC) has been given to those who do not have Aadhaar and who do not wish to obtain Aadhaar for the time being, that their PAN will not be cancelled so that other consequences under the Income Tax Act for failing to quote PAN may not arise,” the CBDT said.

If the PAN is cancelled, then a person cannot do his normal banking and financial operations and hence this relief is given. But, it has been made clear that for filing of ITR or to obtain a new PAN, Aadhaar will be mandatory from July 1, a senior I—T official explained.

Senior officials said the apex court’s order given yesterday was “studied” by a high—level team of authorities from the Law Ministry, Finance Ministry, CBDT and the Income Tax Department after which this clarification has been issued.

Source: http://www.cainindia.org/news/6_2017/aadhaar_must_for_filing_returns_from_july_1_cbdt.html