Income taxpayer base moved up substantially to 6.26 crore at the end of the last fiscal, from nearly 4 crore earlier, CBDT Chairman Sushil Chandra said on Monday.

Clearing the air on disclosure of bank account details of non-resident Indians (NRIs), expats, as well as foreigners with investments in private equity in India, Chandra also said that such accounts need to be disclosed only when a refund is due to the assessee.

The chairman of the Central Board of Direct Taxes (CBDT) said that post demonetisation the department has taken a host of measures to increase tax base and the statement of financial transaction (SFT) report filed by banks shows widening of taxpayer base.

“As on date, we have got 6.26 crore assessees. It is a myth that we have 3-4 crore… (These) assessees who have filed returns, paid advance tax or tax has been deducted at source. This is a large jump from earlier years,” he said speaking at the Income Tax Day celebrations here.

The challenge before the taxmen now remains how to widen the tax net and officials are working towards it, he said.

Chandra said that with the enactment of the amended Benami law, the tax officials have found out clusters and persons who have invested money in real estate without filing tax returns.

The department has also taken enforcement action and under the law, 233 properties has been attached.

With regard to reports on NRIs having to disclose overseas bank account details in tax returns, Chandra said “providing bank account detail is optional and only has to be provided for claiming refunds”.

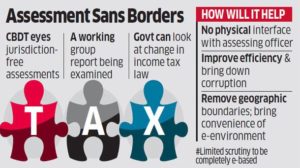

The tax department, he said, will now start working on expanding the process of e-assessment, he said, adding so far limited scrutiny cases are done using technology in 7 cities.

“We are working on the strategy that within two months we will spread limited scrutiny to 100 cities. Limited scrutiny cases which are selected should be done through systems,” he said.

If a case is selected under ‘limited scrutiny’, it means a limit has been set on the enquiries which will only pertain to mismatch or inaccurate reporting. When a tax income- expenditure profile does not match, the department’s automated system throws up a case for limited scrutiny.

Chandra said the next step would be to undertake complete scrutiny on systems so that assessees don’t have to visit tax office. “That will be big challenge and we are working on that,” he said.

Revenue Secretary Hasmukh Adhia said that with the linking of PAN with Aadhaar the entire era of bogus bank account and holding multiple PAN will go away.

He said of the last 25 years, in 11 years the Income Tax department has achieved a growth rate of 20 per cent and even a growth rate of 30 per cent in the year after demonetisation is considered modest.

The government hopes to mop up Rs 9.8 lakh crore from direct taxes in the current fiscal.