On 16th March 2016 Lok Sabha has passed the Companies (Amendment) Bill 2016 to further amend the Companies Act, 2013

On 16th March 2016 Lok Sabha has passed the Companies (Amendment) Bill 2016 to further amend the Companies Act, 2013

The Act introduced significant changes related to disclosures to stakeholders, accountability of directors, auditors and key managerial personnel, investor protection and corporate governance. However, Government received number of representations from industry Chambers, Professional Institutes, legal experts and Ministries/Departments regarding difficulties faced in compliance of certain provisions. Amendments of the Act were carried out through the Companies (Amendment) Act, 2015 to address the immediate difficulties arising out of the initial experience of the working of the Act, and to facilitate “ease of doing business”.

The changes introduced are broadly aimed at addressing difficulties in implementation owing to stringency of compliance requirements; facilitating ease of doing business in order to promote growth with employment; harmonization with accounting standards, the regulations of Securities and Exchange Board of India Act, 1992 and the Reserve Bank of India Act, 1934; rectifying omissions and inconsistencies in the Act, and carrying out amendments in the provisions relating to qualifications and selection of members of the National Company Law Tribunal and the National Company Law Appellate Tribunal in accordance with the directions of the Supreme Court.

The Companies (Amendment) Bill, 2016, inter alia, proposes the following, namely:—

- Simplification of the private placements: Simplification of the private placement process by doing away with separate offer letter, by making filing of details or records of applicants to be part of return of allotment only, and reducing number of filings to Registrar;

Earlier, there was significant difficulty was created by the Companies Act, with the unduly restrictive set of provisions pertaining to private placements. This over-ambitious scheme of regulation was a direct result of some incidents in the past. One such provision requires every private placement to be routed through a separate bank account opened for this purpose, and a bar on utilization of the money until allotment. More often than not, the amount received in private placement is large, and companies cannot afford to keep the amount idle.

Now, this private placements process has been simplified with the Companies (Amendment) Bill, 2016.

(b) Allow unrestricted object clause in the Memorandum of Association dispensing with detailed listing of objects, self-declarations to replace affidavits from subscribers to memorandum and first directors;

(c) Provisions relating to forward dealing and insider trading to be omitted from the Act;

(d) Requirement of approval of the Central Government for Managerial remuneration done away with:

Requirement of approval of the Central Government for Managerial remuneration above prescribed limits is replaced by approval through special resolution by shareholders;

Central Government control on managerial remuneration is eliminated. Section 197, which places limits on managerial remuneration, will now require special resolution only, if the limits placed under the law are exceeded.

(e) Loans to entities in which directors are interested:

A company may give loans to entities in which directors are interested after passing special resolution and adhering to disclosure requirement;

(f) Provisions easing business by overseas entities

In support of the “Make in India” policy, it is quite appropriate that the Companies (Amendment) Bill, 2016 must have enabled foreign owned businesses to form companies in India. Accordingly, there are several provisions to facilitate foreign-owned businesses:

– EGM of a wholly-owned subsidiary of a foreign company may be called anywhere in India.

– The requirement for a resident director provided in section 149 is sought to be amended to provide that in case of newly incorporated companies the condition may be satisfied subsequent to incorporation, rather than before incorporation.

– Remove restrictions on layers of subsidiaries and investment companies

(g) Allow for exempting class of foreign companies from registering and compliance regime under the Act;

(h) Align prescription for companies to have Audit Committee and Nomination and Remuneration Committee with that of Independent Directors;

(i) Test of materiality to be introduced for pecuniary interest for testing independence of Independent Directors;

(j) Disclosures in the prospectus required under the Companies Act and the Securities and Exchange Board of India Act, 1992 and the regulations made thereunder to be aligned by omitting prescriptions in the Companies Act and allowing these prescriptions to be made by the Securities and Exchange Board of India in consultation with the Central Government;

(k) Provide for maintenance of register of significant beneficial owners by a company, and filing of returns in this regard to the Registrar;

(l) Removal of requirement for annual ratification of appointment or continuance of auditor;

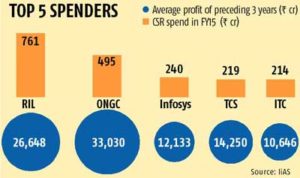

(m) Amend provisions relating to Corporate Social Responsibility to bring greater clarity.

http://www.prsindia.org/uploads/media/Companies,%202016/Companies%20bill,%202016.pdf