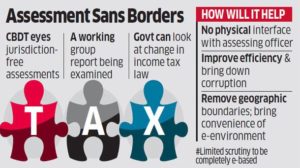

The one-nation, one-tax principle that underlines the goods and services tax (GST), set to be rolled out on July 1, could be adopted in a much more broader sense by the income tax department through a path-breaking initiative on jurisdiction-free assessment.

This would mean that a taxpayer in Mumbai could be assessed by an income tax officer located in Patna, a significant leap toward eradicating corruption by reducing the need for face-to-face contact between citizens and tax officials to the absolute minimum besides speeding up processing.

The move, which will require a change in the income tax law, would also end the relevance of various geographic divisions in the form of wards and circles with the whole country becoming one jurisdiction. This, it is hoped, will put an end to a system in which bribery is said to be used as a tool to ease processes through human intervention.

A high-level internal report of the Central Board of Direct Taxes (CBDT) recommended the move, which is under active consideration, a senior official told Economic Times.

“We are looking at it,” the CBDT official said.

The government may consider implementing the process in the next financial year.

The Catalyst

The key catalyst for such a significant reform is the massive shift toward e-filing of returns, which is already jurisdiction-free with returns going to the Central Processing Centre in Bengaluru.

In the last financial year, over 42.1 million tax returns had been filed online by February. The number of e-returns processed by then was 43 million, which included some backlog from previous years.

Multiple Benefits

In line with this move towards e-processing, the income tax department may even opt for e-scrutiny for all limited scrutiny cases where assesses can explain the transactions in question over email, the official said.

A complete jurisdiction-free environment would make geography redundant and the income tax department completely faceless for taxpayers. Any review or scrutiny of return could happen anywhere in India through an electronic interface, ensuring that the payee is not forced to interact with officials. “A taxpayer would not need to have any physical interface with his assessing officer,” said the official cited above.

CBDT had earlier constituted a seven-member committee to formulate a Standard Assessment Procedure for e-scrutiny to promote greater certainty, transparency and accountability. The board has in recent times taken a number of initiatives to reduce the face-to-face contact between tax officials and assessees and make the system non-adversarial.

These include directing field offices to raise only specific queries in income tax assessment cases picked up for scrutiny. It also directed the expeditious completion of those scrutiny cases where income concealed is up to Rs 5 lakh. “Jurisdiction-free assessment will help the tax department plan and allocate assessment work across the country,” said Jiger Saiya, partner, direct tax, BDO India.

Source: http://economictimes.indiatimes.com/articleshow/59026099.cms