The 31st GST Council meeting concluded today under the guidance of Union Minister Arun Jaitley has taken some important decisions including the due date extension for GST Annual Returns and some other Returns.

As per the recommendation of the Council, the due date for furnishing the annual returns in FORM GSTR-9, FORM GSTR-9A and reconciliation statement in FORM GSTR-9C for the Financial Year 2017 – 2018 shall be further extended till 30.06.2019.

Further, the due date for furnishing FORM GSTR-8 by e-commerce operators for the months of October, November and December 2018 shall be extended till 31.01.2019.

The due date for submitting FORM GST ITC-04 for the period July 2017 to December 2018 shall be extended till 31.03.2019. ITC in relation to invoices issued by the supplier during FY 2017-18 may be availed by the recipient till the due date for furnishing of FORM GSTR-3B for the month of March 2019, subject to specified conditions.

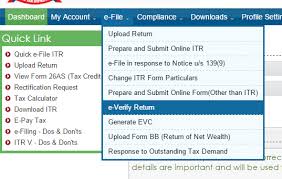

All the supporting documents/invoices in relation to a claim for refund in FORM GST RFD-01A shall be uploaded electronically on the common portal at the time of filing of the refund application itself, thereby obviating the need for a taxpayer to physically visit a tax office for submission of a refund application.

GSTN will enable this functionality on the common portal shortly. The due date for the taxpayers who did not file the complete FORM GST REG-26 but received only a Provisional ID (PID) till 31.12.2017 for furnishing the requisite details to the jurisdictional nodal officer shall be extended till 31.01.2019.

Also, the due date for furnishing FORM GSTR-3B and FORM GSTR-1 for the period July 2017 to February, 2019/quarters July 2017 to December 2018 by such taxpayers shall be extended till 31.03.2019

Late fee shall be completely waived for all taxpayers in case FORM GSTR-1, FORM GSTR-3B &FORM GSTR-4 for the months/quarters July, 2017 to September, 2018, are furnished after 22.12.2018 but on or before 31.03.2019.

Source: Recommendations-made-during-31st-Meeting-of-the-GST Council

Source: