Despite a crying need for better infrastructure, investment in it has actually fallen in 10 major economies since the financial crisis, including the US, according to a new study by the McKinsey Global Institute. Meanwhile, China is still going gangbusters on roads, bridges, sewers, and everything else that makes a country run.

Despite a crying need for better infrastructure, investment in it has actually fallen in 10 major economies since the financial crisis, including the US, according to a new study by the McKinsey Global Institute. Meanwhile, China is still going gangbusters on roads, bridges, sewers, and everything else that makes a country run.

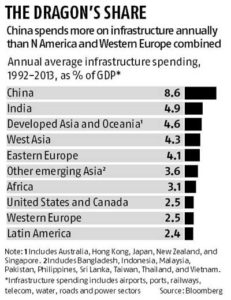

“China spends more on economic infrastructure annually than North America and Western Europe combined,” according to the report published Wednesday.

Economists around the world have been arguing that now is a great time to invest in infrastructure because interest rates are super-low and the global economy could use the spending jolt. “Is anyone proud of Kennedy airport?” Harvard University economist Lawrence Summers likes to ask.

The MGI report cites 10 countries where infrastructure spending fell as a share of gross domestic product from 2008 to 2013: the US, UK, Italy, Australia, South Korea, Brazil, India, Russia, Mexico, and Saudi Arabia. The study counts 11 economies, but that’s because it lists the European Union as a separate entity.

In contrast to the widespread declines, the institute says, infrastructure spending grew as a share of GDP in Japan, Germany, France, Canada, Turkey, South Africa and China. The chart from the MGI report shows China’s strength in infrastructure spending. Its bar is the highest. There’s such a thing as too much infrastructure spending, of course. At current rates of investment, China, Japan, and Australia are likely to exceed their needs between now and 2030, the McKinsey & Co-affiliated think tank says. To fund more public infrastructure, the report favours raising user charges such as highway tolls, among other measures.

In contrast to the widespread declines, the institute says, infrastructure spending grew as a share of GDP in Japan, Germany, France, Canada, Turkey, South Africa and China. The chart from the MGI report shows China’s strength in infrastructure spending. Its bar is the highest. There’s such a thing as too much infrastructure spending, of course. At current rates of investment, China, Japan, and Australia are likely to exceed their needs between now and 2030, the McKinsey & Co-affiliated think tank says. To fund more public infrastructure, the report favours raising user charges such as highway tolls, among other measures.

To encourage more private investment in infrastructure, MGI argues for increasing “regulatory certainty” and giving investors “the ability to charge prices that produce an acceptable risk-adjusted return.”