Japanese conglomerate Sumitomo is at an advanced stage of negotiations to acquire a substantial equity stake in Excel Crop CareBSE -0.87 % , a Mumbai-headquartered listed company. The proposed deal could pave the way for the Japanese group to own about 44% shares of the pesticides and agrochemicals company for a total consideration ofRs 1,200-1,300 crore.

Japanese conglomerate Sumitomo is at an advanced stage of negotiations to acquire a substantial equity stake in Excel Crop CareBSE -0.87 % , a Mumbai-headquartered listed company. The proposed deal could pave the way for the Japanese group to own about 44% shares of the pesticides and agrochemicals company for a total consideration ofRs 1,200-1,300 crore.

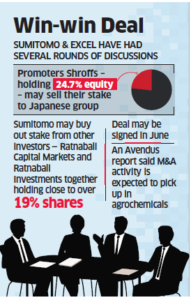

Sumitomo plans to buy out stake of Excel promoters — the Shroff family — holding 24.7% equity as well as two financial investors together owning close to 19% of the shares. ET’s email to Dipesh Shroff, managing director of Excel Crop Care, and Sumitomo Chemical went unanswered.

There have been several rounds of talks between officials of Sumitomo Chemical and the Excel management, and indications are that the deal may be signed in June. Nufarm, the Australian crop protection and specialist seeds company, owns more than 14% and is likely to retain its strategic stake in Excel Crop Care.

According to a report by Avendus Capital, global players are looking at India to increase their market share, add to their product portfolio , and strengthen their supply base in specialty and agrochemicals. “The Indian agrochemicals market is expected to grow rapidly (about 12% CAGR over 2014-19) with increase in farmer awareness, improvement in rural income and increase in pressure for improving productivity,” said Preet Mohan Singh, executive director, Avendus Capital.

According to a report by Avendus Capital, global players are looking at India to increase their market share, add to their product portfolio , and strengthen their supply base in specialty and agrochemicals. “The Indian agrochemicals market is expected to grow rapidly (about 12% CAGR over 2014-19) with increase in farmer awareness, improvement in rural income and increase in pressure for improving productivity,” said Preet Mohan Singh, executive director, Avendus Capital.

The Shroffs are also the promoters of Excel Industries, a specialty chemicals company, and co-promoters of Aimco Pesticides in which they control a little over 25%. Before entering into any agreement with Sumitomo, the Shroffs are expected to conclude the inter se transfer of their holding to the other promoter family of Aimco. Excel Crop Care has 1.13% equity interest in Excel Industries.

Besides Shroffs, the other two shareholders of Excel Crop Care who may sell their shares to Sumitomo are Ratnabali Capital Markets (holding 14.99%) and Ratnabali Investments (3.95%). Among the institutional shareholders of Excel Crop Care are Life Insurance Corporation (6.58%) and DSP Blackrock (1.92%).

Excel Crop Care’s consolidated net profit for the quarter ended March 31, 2016 was Rs 7.6 crore as against Rs 1.7 crore in the year ago period, on total income of Rs 188.6 crore (Rs 205.6 crore). The Excel Crop Care stock has been trading at around Rs 1,109, against 52-week high and low of Rs 1,247 and Rs 750, respectively.

M&A activities in sectors like agro and specialty chemicals is expected to pick up, said Avendus, adding that the stride towards food security will also increase the significance of agrochemicals. An estimated 85% of India’s crop loss (worth close to $20 billion) is caused by pest infestation, disease and weeds and is prevented by the use of agrochemicals.

India exports agrochemicals to countries like the us , France, the Netherlands, Belgium, Germany, Brazil, Colombia, China, Vietnam and Indonesia.

Source: http://economictimes.indiatimes.com/articleshow/52392474.cms