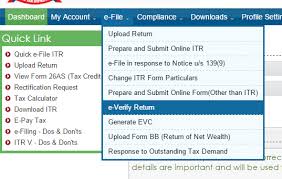

1. Within 2 years, Tax assessment will be done electronically

2. IT returns processing in just 24 hours

3. Minimum 14% revenue of GST to states by Central Govt.

4. Custom duty has been abolished from 36 Capital Goods

5. Recommendations to GST council for reducing GST rates for home buyers

6. Full Tax rebate upto 5 lakh annual income after all deductions.

7. Standard deduction has been increased from Rs. 40,000 to Rs. 50,000

8. Exemption of tax on second self-occupied house

9. Ceiling Limit of TDS u/s 194A has increased from Rs.10,000 to Rs. 40,000

10. Ceiling Limit of TDS u/s 194I has increased from Rs. 1,80,000 to Rs. 2,40,000

11. Capital Gains Tax Benefit u/s 54 has increased from investment in one residential house to two residential houses.

12. Benefit u/s 80IB has increased to one more year i.e. 2020

13. Benefit has been given to unsold inventory has increased to one year to two years.

Other Areas

14. State share has increased to 42%

15. PCA restriction has abolished from 3 major banks

16. 2 lakhs seats will increase for the reservation of 10%

17. 60000 crores for MANREGA

18. 1.7 Lakh crore to ensure food for all

19. 22nd AIIMS has to be opened in Haryana

20. Approval has to be given to PM Kisan Yojana

21. Rs. 6,000 per annum to be given to every farmer having upto 2 hectare land. Applicable from Sept 2018. Amount will be transferred in 3 installments

22. National Kamdhenu Ayog for cows. Rs. 750 crores for National Gokul Mission

23. 2% interest subvention for farmers pursuing animal husbandry and also create separate department for fisheries.

24. 2% interest subvention for farmers affected by natural calamities and additional 3% interest subvention for timely payment.

25. Tax free Gratuity limit increase to Rs. 20 Lakhs from Rs. 10 Lakhs

26. Bonus will be applicable for workers earning Rs. 21,000 monthly

27. The scheme, called Pradhan Mantri Shram Yogi Mandhan, will provide assured monthly pension of Rs. 3,000 with contribution of Rs. 100 per month for workers in unorganized sector after 60 years of age.

28. Government delivered 6 crores free LPG connections under Ujjawala scheme

29. 2% interest relief for MSME GST registered person

30. 26 weeks of Maternity Leaves to empower the women

31. More than 3 Lakhs crores for defence

32. One lakh digital villages in next 5 years

33. Single window for approval of India film maker.